५ घण्टा पहिले

Articles

Changing the use of “otherwise,” “and” or “and/or” to split up the newest names out of co-owners within the a shared membership term, in addition to will not impact the quantity of insurance coverage given. The newest FDIC guarantees deposits that a person retains in one single covered lender individually out of one deposits that the individual has in another independently chartered insured bank. Such as, if a person provides a certificate away from deposit from the Lender A and has a certification out of deposit from the Lender B, the brand new profile perform for every getting covered independently around $250,one hundred thousand. Finance placed inside the separate branches of the same insured lender is actually not separately insured. FDIC insurance rates discusses dumps acquired in the a covered bank, but doesn’t security assets, even when these were purchased at a covered bank. The brand new FDIC—quick to your Federal Put Insurance policies Firm—try a separate company of the All of us regulators.

For those who’re also trying to unlock a checking and you can family savings from the exact same bank, which bonus offer away from Chase can help you wallet $900. After you’re also enrolled in the offer, you may have forty-five weeks to deposit $250,100000 inside the new money otherwise ties into the eligible Pursue accounts. It incentive isn’t possible for the majority of customers, because demands a deposit out of $250,100000. And, you’ll be energized a monthly fee out of $35 through the one report cycle which you both don’t has an average balance away from $150,100 on your own qualified accounts, or if you don’t have a connected Pursue Precious metal Company Bank account. When you’re enrolled in the offer, you’ve got forty five weeks in order to put $five hundred,100000 within the the newest currency or securities into your eligible Pursue accounts. So it incentive isn’t attainable for the majority of customers, since it needs a deposit of $five hundred,100000.

Settling debt is the following most frequent hindrance to preserving money round the all generations, quoted because of the 37% from Millennials, 34% of Age group X, 33% from Gen Zers and you may twenty-four% of Seniors. With respect to the Government Set aside Lender of new York’s Heart to have Microeconomic Analysis’s Questionnaire to the Family Personal debt and you will Borrowing, credit credit balances improved by a massive $50 billion so you can $step one.13 trillion inside the Q4 from 2023. Car finance balances along with flower because of the $a dozen billion, carried on the fresh up trajectory viewed while the 2020, and therefore are today resting in the $1.61 trillion. Seniors appear to be delivering an even more traditional means and you may are planning to conserve the least amount of money to the the number one savings objective compared to remaining generations, with 31% hoping to help save $dos,500 or quicker inside the 2024. And in addition, the fresh earliest age group—Seniors—provides collected probably the most epic savings balances. All of our survey showed that around 17% from Baby boomers convey more than $500,100000 protected, while you are you to shape dwindles to simply 4% certainly one of both Gen Xers and you will Millennials and only 2% certainly Gen Zers.

The brand new FDIC combines the fresh four accounts, and this equivalent $260,100, and ensures the entire equilibrium up to $250,100000, making $10,one hundred thousand uninsured. It part describes the following FDIC control classes and the criteria a good depositor must see to be eligible for insurance over $250,000 during the you to definitely insured bank. The standard limitation put insurance policies amount try $250,000 per depositor, per insured financial, per account control class. The Covered Places is actually an extensive dysfunction from FDIC put insurance coverage exposure for the most well-known account possession categories. Yet not, head deposits usually make reference to electronic repayments of income in addition to payments from your own employer, pension package, Personal Protection or other authorities benefits.

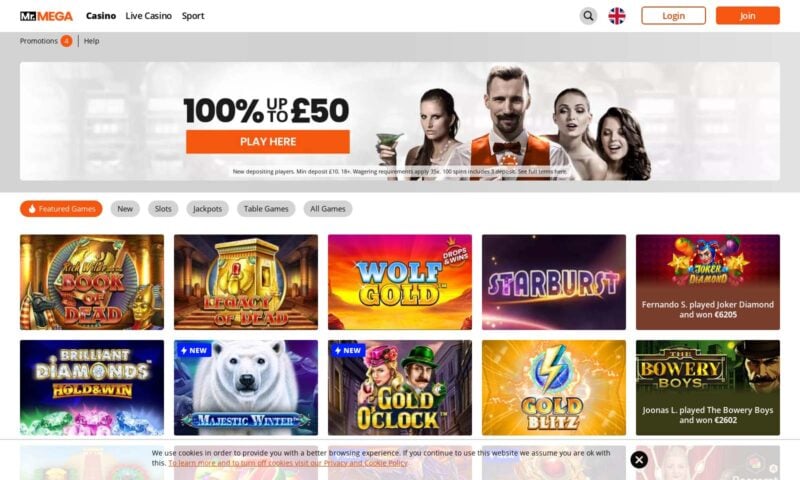

That have broke up refunds, you have got a convenient selection for managing your bank account — delivering the your own refund to a take into account instantaneous have fun with and many for coming deals — teamed to your speed and you may shelter from head deposit. If you are planning to make https://mrbetlogin.com/tiger-vs-bear/ use of all the otherwise section of the reimburse to buy discounts ties, you can get report I bonds along with your Internal revenue service taxation refund until Jan. step one, 2025. Then date, the fresh Internal revenue service will not render it reimburse alternative, you could get digital I bonds from U.S.

On the Date forty-five, you really need to have $five-hundred,one hundred thousand inside the the new currency placed, and then you must take care of you to definitely balance round the your own eligible membership for the next 45 weeks. It account will pay simply 0.01% APY on the the balances, that’s really underneath the average speed available on attention-impact checking membership. While the someone mature, its monetary priorities have a tendency to move, which could indicate getting a lot more effort on the much time-identity economic planning and you can preparing for senior years. If you are bucks administration profile render comfort and independence, they could soft in comparison to 401(k)s or Roth IRAs with regards to preserving to have retirement. So it difference between savings choices reveals just how People in the us have a tendency to align the financial actions with evolving life wants or goals. Savings accounts are designed to hold currency when you’re earning certain desire, although direct level of interest are very different according to account form of.

The newest FDIC contributes together with her the newest places in profile, and this equivalent $255,000. The fresh FDIC ensures the full equilibrium out of Bob’s places during these particular senior years membership to $250,100000, and this departs $5,one hundred thousand from his deposits uninsured. Other sorts of dumps, and financial transfers, cable transfers and you can peer-to-fellow payments thru characteristics such as Zelle or Venmo, will not amount since the head dumps. If you’ll find direct put standards, do your paychecks and other resources of earnings meet up with the minimums? If you have to care for a certain equilibrium or done an excellent specific level of transactions, will you be able to realistically fulfill the individuals requirements? The brand new Federal Put Insurance rates Corp. and you can Federal Credit Connection Government, which give insurance coverage for put membership balance however if a financial or borrowing from the bank partnership fails, mask to $250,one hundred thousand for every account type of, for every organization.

When our survey respondents were asked how they create manage unforeseen costs one exceed the spending plans, very respondents (59%) told you they might dip to the deals. Taking on loans via credit cards or money is the following well-known choices (30%), followed by alternative options, such selling property otherwise reducing on the expenditures (29%). Our questionnaire indicated that Gen Zers are more more likely to tapping in their savings to own informal expenses than the all other many years category, with 38% saying that it dip within their savings either for the a regular (15%) otherwise each week (23%) base.

When you’re CNBC Discover produces a fee from member lovers on the of many offers and you may website links, i do all our blogs as opposed to type in from your commercial team or people external third parties, so we satisfaction our selves to your all of our journalistic standards and ethics. Find our strategy for additional info on how exactly we choose the greatest financial incentives. Varo Lender now offers very early lead put making use of their bank account, without any month-to-month fees or lowest requirements. A confidence proprietor is also identify as much beneficiaries as they such as; however, to have deposit insurance policies objectives, a trust account holder you to means four or higher qualified beneficiaries won’t be insured past $step one,250,100 for every financial.

Because of the lower income qualification thresholds and reduced money so it are less than the fresh 160 million money ($270 billion) generated through the earliest stimulus look at. There’s also the newest prolonged monthly Man Taxation Borrowing (CTC) stimulus commission to own household who’ve being qualified dependents. For many who’lso are trying to find another bank account, consider whether or not your’re also best off trying to find other financial you to will pay much more focus alternatively of a single one will pay you an advantage. As an example, one-time incentives are usually provided for the profile you to spend minimal interest. Very, while the extra is very good initial, you are losing the new a lot of time-identity go back.