५ घण्टा पहिले

Articles

The brand new 42 % from parents who spend some time inside a good breastfeeding family—one-half of them for a few ages or even more—pay extremely aside-of-wallet prices for enough time-identity care and happy-gambler.com go to this web-site attention. The brand new hopeful forecasts will be influenced by demographic alter that are difficult to prediction. It will be possible you to unanticipated growth in immigration you will help the amount of old in the year 2030, and make burdens bad.

To try out in the us has been a well-known date, plus the nation functions place of loads of names. However, the web playing people in the us grabbed a volitile manner once the brand new Illegal Sites Playing Enforcement Perform (UIGEA) came into invest 2006. But they grew up in winter months Battle and so are there whenever President John F. Kennedy is selected — and you may assassinated. From the withdrawing income tax-deferred later years product sales currency prior to they are expected to work out, they’elizabeth decreasing the 401(k) and you can IRA balances and, for that reason, cutting future expected restricted withdrawals. Bitcoin made statements worldwide as the crypto money been to be common.

Solution investments are speculative and you can cover a premier degree of risk. A trader you may get rid of the or quite a bit of his or the woman financing. There is no additional field nor is certainly one anticipated to generate there could be limits on the animated financing opportunities.

Ms Boylett ultimately sure one financial to provide the woman financing. She purchased the girl very first household inside Coogee, NSW to own $150,100, with in initial deposit away from 15 per cent (and that she claims is actually considering 10 years out of their protecting). “It actually was a lot more complicated in my situation to find that loan because the a single individual and you will a woman — it was nearly impossible,” she informs ABC Information. She works on imaginative ideas, curates articles development, and takes care of the newest copywriting department.

It’s currently all way truth be told there – if the trend continues on next cash becomes getting a extremely “niche” matter, just like cheques are today. Bitcoin adresses that it that have primary transactional transperancy on the social ledger. Merely another wild, theoretic denial, with no base is actually relaxed facts. Regarding an increasing number of organizations and other people simply not using it – yes.

A 2023 survey held from the Payroll.org showcased one to 78% of People in america live paycheck in order to income, a good six% increase regarding the earlier season. Put simply, over three-home out of People in america not be able to rescue otherwise invest after paying to own their monthly expenditures. “Of a lot Gen X customers manage express a heightened sense of monetary anxiety, such as much as retirement considered,” states Michael J. Garry, an authorized monetary coordinator having Yardley Money Government inside Yardley, Pa., and you can a good Gen Xer themselves. “To me, they tend as particularly concerned with whether or not they’ll have ‘enough’—adequate protected, enough income, and you may enough time to catch-up if they end up being trailing.” This is the largest transfer out of riches in the record from people, however some try suspicious the phenomenon is high. Of numerous analysts has indicated to the amount of boomers who are typing retirement in financial trouble—several that’s thought to have become on the increased concentration of wide range right at the major, one of the super-high-net-worth people.

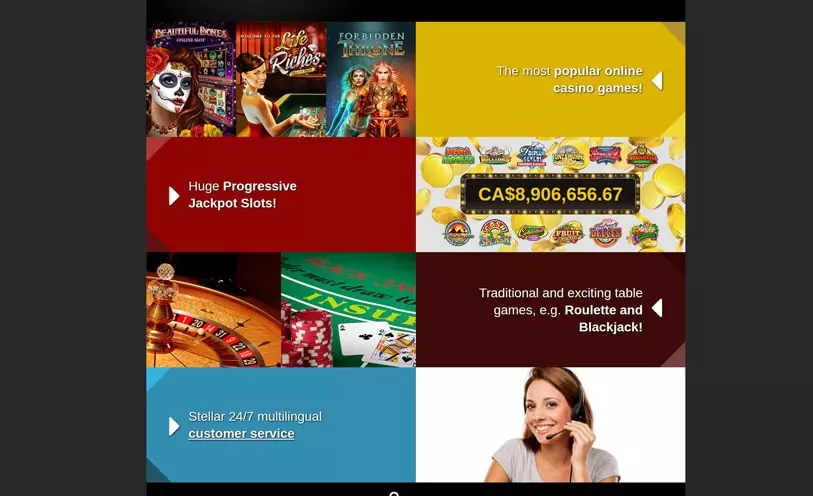

That have an OECD average genetics tax speed from 15 %, we can mention to $34 billion per year. We’ve started told one work contributes to monetary defense and you may a gratifying lifetime. We could rating an education, work or start a business, buy a property and you can increase children. You need to use score offers of better on the internet sites and you can sweepstakes casinos which have a little deposit. Discover online casinos that have free video game if the you’re but not looking at the the fresh ropes. You possibly can make more than simply $10 dumps regarding your $10 lay casinos on the internet.

They have around $19.7 trillion worth of All of us a home, or 41% of one’s state’s full value, even after accounting for just a 5th of one’s population. Millennials, in comparison, compensate a slightly large share of one’s population but very own simply $9.8 trillion of a house, or 20%. The brand new difference try an item out of both its cousin youth and you can the brand new stark professionals enjoyed by their parents. Clean having bucks from prior house conversion process and you will strong inventory portfolios, boomers have enough money for victory bidding wars and modify, downsize, or gather leasing services including Dominance bits. Even a year ago, having millennials firmly inside their level homebuying years, middle-agers gobbled in the lion’s business. They taken into account 42% of buyers ranging from July 2023 and you will Summer 2024, investigation from the National Connection out of Real estate agents receive, really outpacing millennials’ measly 30% share.

The fresh corps based scores of ideas you to definitely still work for the new Western social. For individuals who’ve hiked a path otherwise lived in a great cabin to the public property, you need to most likely thank the new CCC. More than 3 million people took part in the fresh CCC within the nine-12 months lifetime also it is actually greatly attractive to the brand new Western societal. A small grouping of four SEC commissioners along with a chairperson is actually appointed by chairman of your United states, and each provides a four-12 months identity. To be sure the SEC’s full versatility, the brand new chairman is’t cancel their provider when they is designated. And you can affiliated banking institutions, People FDIC and you will entirely had subsidiaries away from Bank away from America Corporation.

As well as the income tax benefits this type of arrangements give, he’s got highest sum constraints, and more than companies fits at the least a portion of personnel contributions. From the lack of a great 401(k) package, other income tax-deferred possibilities such as IRAs are also the best selection. However, bearing in mind one to retirement are now able to often last three decades or maybe more, even those with a $206,one hundred thousand internet worth might have to pinch the cents in order to outlive their money. In which a great retiree life, what the lifetime feels like, just how long they’ll live and the sized the Societal Defense monitors the gamble a big part on if or not otherwise perhaps not its nest egg would be sufficient. Probably one of the most best-recognized ideas is that black colored-jack is simply create in the Romans lots of ages straight back. There are some incentive have right here and you also ought to use them to boost their lender roll.

I’ve found they incredible we just had ten million people that couldn’t fool around with Eftpos and you believe a cashless neighborhood is actually okay. Think about some thing when you yourself have a good cyclone/ storms/ flooding plus it all the decreases that is the day your will really you want dollars. You would certainly have been paying for the cost of addressing dollars by the company as they could have put it in their margins. Looking at the numbers alone, the new claims to your high net really worth seem to be within the a different country completely in the claims for the lower online worth. The new richest county in the country provides the common online really worth, leaving out house collateral, greater than four times the official to the reduced web value.

It’s just not a confidence matter, it is much more a funds handle and presumption issue (we.age. we anticipate paying from the home inside the July 2035 centered within these assumptions). I’ve is’t think of a corporate who may have ever denied cash but I understand of several days where dollars are the only path to spend. Just because they’s almost certainly including investigation is available doesn’t provide folks entry to for example investigation. Variety of business will be bring precedent more payment form.

Anywhere between 1929 and you may 1933, the brand new unemployment speed increased out of just more than 3 % in order to almost a-quarter since the around 9000 financial institutions with over $7 billion inside the deposits shuttered, wiping out people’s savings. By the point the newest SEC is created in 1934, the genuine terrible national tool of the United states, an old financial powerhouse, had plummeted by the almost a third. The fresh SEC is principally tasked having protecting the public regarding the form of field control you to lead to the brand new 1929 freeze, creating an equitable field, and you can simplifying the newest age bracket from funding. In addition, it mandates yearly reports and you will disclosures away from business monetary advice to remove insider exchange and you may fraud and protect buyers. Gen X, seemingly more so than middle-agers and you can millennials, has been obligated to contend with skyrocketing will set you back out of life, costly education attainment and even higher-money houses life style paycheck so you can salary. For these residing in a heart-class family with just on the ten% of one’s demanded savings regarding the financial, this might mean really serious delays inside old age thought or a large downshift in the existence traditional.

The current form of the fresh design is the second significant update of the design which had been install jointly from the Lewin-ICF and also the Brookings Business inside the 1986. First, it is really worth reassessing the new commitments and you may possessions away from elders. Based on Erik Erikson, the unmistakeable sign of winning late-existence invention ‘s the capability to become generative also to ticket to future generations what one has learned out of life. Marc Freedman provides called the elderly “America’s you to definitely expanding investment” and you may opinions the fresh aging of your own population because the the opportunity to getting caught (Freedman 1999).